Introduction

Byline: FinancialDocsProvider Editorial Team • Published: August 2025

Last updated: August 2025

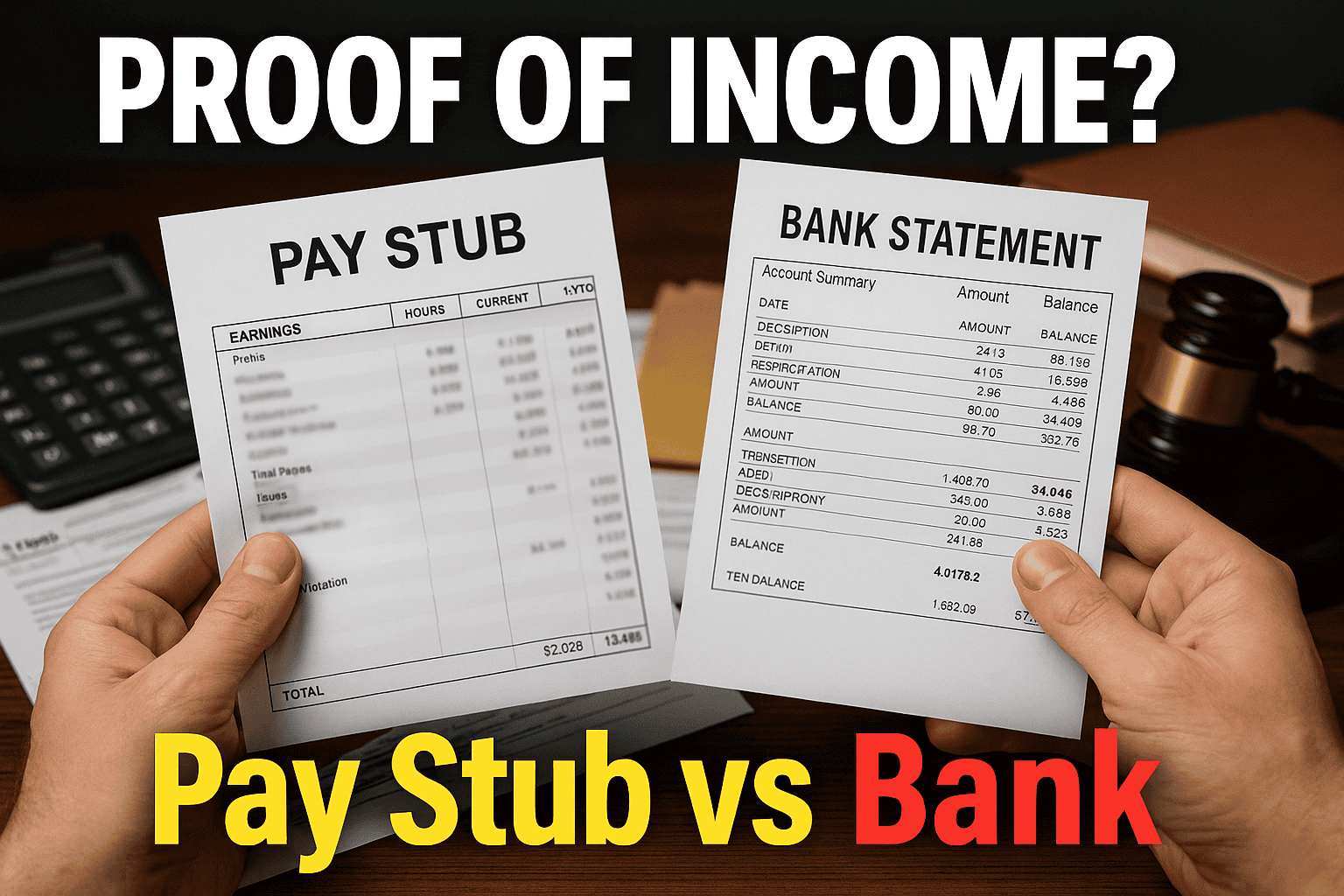

If you’re comparing Pay Stub vs Bank Statement for Proof of Income, you’re not alone. Lenders, landlords, and underwriters ask for income proof to assess ability to pay, verify stability, and confirm the source of funds. The “best” document depends on who’s asking, your employment type, and how predictable your income is.

At FinancialDocsProvider.com, we provide compliance‑first editing and formatting so your paperwork is organized, readable, and easy to verify. We help you package what you already have—no fabrication, no altered numbers. If you need polished PDFs or secure redaction, our proof of income editing can reduce avoidable delays and rejections.

Related Entities & Terms

- Pay stub / payslip (US/UK/CA), payroll statement, remittance advice

- Bank statement, transaction history, deposit verification

- W‑2 (US), 1099 (US), T4 (Canada), T1 General & Notice of Assessment (NOA, Canada), P60/P45/SA302 (UK)

- Direct deposit, gross vs. net pay, year‑to‑date (YTD)

- Underwriting, income verification, affordability assessment

- IRS, CFPB (US); GOV.UK/HMRC (UK); CRA/FCAC (Canada)

- Employment verification letter, offer letter, profit & loss (P&L)

- Bank statement loans (non‑QM), manual underwriting

- Data redaction, metadata, PDF/A, accessibility tagging

How we help: we clean layout, fix garbled exports, combine documents into tidy packets, and redact sensitive data where lawful. We do not change factual values, dates, parties, or transaction descriptions. Doing so may be illegal and could constitute fraud.

Law & Legality Basics (US, UK & Canada)

Across jurisdictions, there’s a bright line between formatting a document you already have and falsifying information. Formatting is legal when it doesn’t alter facts. Falsification—changing amounts, dates, employers, or bank transactions—is prohibited and can trigger serious penalties.

United States: consumer protection & underwriting

In the US, lenders and landlords use income documents to assess ability to repay and risk. Government bodies and regulators emphasize truthful, verifiable documentation. Falsifying income for credit or housing can expose an applicant to civil consequences and, in egregious cases, criminal exposure under laws related to fraud or false statements. Underwriters often cross‑check pay stubs against employer payroll systems, W‑2s, and bank deposits.

United Kingdom: affordability & evidence of earnings

In the UK, affordability assessments typically rely on payslips, bank statements, or HMRC evidence (e.g., SA302 for self‑assessment). Lenders may ask for multiple months to view income patterns, bonuses, and deductions. Intentionally misleading a lender can result in application refusal and further action.

Canada: verification across CRA & banking

In Canada, proof commonly includes recent pay statements, T4s, and a CRA Notice of Assessment (NOA) for self‑employed borrowers. Lenders may request several months of bank statements to confirm deposits. Misrepresentation of income can lead to denial and additional consequences.

Bottom line: You can improve legibility, organization, privacy, and export quality. You cannot change facts. When in doubt, clarify requirements with the requesting party before submitting.

What Edits Are Allowed (Formatting, Not Falsifying)

Permissible edits make your authentic documents easier to read and verify. They never alter numbers, identity, or timing.

Redaction & Privacy

- Masking account numbers except the last 4 digits.

- Hiding unrelated transactions (e.g., medical) when the requester allows it.

- Blurring QR codes/barcodes that expose sensitive internal IDs.

Legibility & Layout

- Correcting garbled text from payroll or banking exports.

- Reflowing columns so totals and YTD values align.

- Adding accessible tags, bookmarks, table headers, and selectable text.

- Converting images to searchable PDFs; fixing page orientation and margins.

Export & Packaging Fixes

- Merging multiple stubs into one PDF packet with a table of contents.

- Compressing files without degrading legibility.

- Standardizing date formats, page numbering, and filenames.

Mini‑Scenarios

- Renter: Your landlord needs three months of pay stubs. We combine them into a single, well‑labeled PDF, ensuring YTD lines remain readable.

- Gig worker: You receive weekly payouts. We compile a deposit summary from your bank statements and add a clear cover sheet that references each page.

- New hire: You have one stub plus an offer letter. We package both, preserving original values and dates.

What’s Illegal (and Why It’s Not Worth It)

Illegal alterations attempt to change reality. Even small changes can be discovered by automated checks, verification calls, or data matching.

Examples of Prohibited Alterations

- Changing gross, net, or YTD amounts on a pay stub.

- Editing hours, overtime, bonuses, or tax withholdings.

- Altering pay dates, check numbers, or pay periods.

- Inserting, removing, or relabeling bank transactions or deposit descriptions.

- Swapping employer names or addresses; fabricating logos or letterheads.

- Creating “synthetic” statements or stubs from scratch.

Consequences You Should Expect

- Application denial and internal fraud flags with lenders or property managers.

- Loss of future eligibility with the same institution.

- Potential legal liability under fraud or false statement laws.

Use Cases: Pay Stub vs Bank Statement for Proof of Income

Both documents prove income, but they serve slightly different purposes. A pay stub shows your earnings details—gross, taxes, deductions, and net pay—usually for a single pay period with year‑to‑date totals. A bank statement shows cash actually received and how it flows into your account over time.

Renters & Property Managers

- When pay stubs win: W‑2 employees with predictable salary or hourly wages. Clear YTD helps confirm stability.

- When bank statements help: To show rent is affordable after other obligations. Some landlords want both.

- Tip: Provide the most recent 2–3 pay periods plus 2–3 months of statements if requested. Add an optional employer letter if available.

Auto Loans & Insurance

- When pay stubs win: Dealers and finance arms often prefer recent stubs to confirm net take‑home and deductions.

- When bank statements help: To prove regular deposits, especially for variable hours or gig income.

Mortgages & Underwriting

- When pay stubs win: For salaried borrowers, underwriters review current stubs plus W‑2s and may request a verification of employment.

- When bank statements help: To verify earnest‑money sources, reserves, and payroll deposits. Some non‑QM programs rely on business bank statements for self‑employed borrowers.

- Tip: Expect to provide a consistent history—often two years of income evidence for mortgages.

SBA & Small‑Business Borrowing

- Traditional programs may review personal and business returns, a profit & loss statement, and several months of bank statements.

- Pay stubs are relevant if you pay yourself through payroll; otherwise, statements and tax filings are key.

Gig, Freelance & Commission‑Based Workers

- When pay stubs win: If your platform or employer issues proper payslips.

- When bank statements help: Many platforms pay via direct deposit; statements show actual cash flow and can be summarized to highlight recurring income.

W‑2 vs. Self‑Employed Packet Guidance

For W‑2 employees:

- Latest 2–3 pay stubs (showing employer, gross, net, YTD).

- W‑2s for the last 1–2 years.

- 2–3 months of bank statements to match deposits to stubs if requested.

For self‑employed/1099/gig:

- Recent bank statements (often 3–12 months) showing business or personal deposit patterns.

- Recent tax filings (US: 1040 + Schedule C; UK: SA302 + tax year overview; Canada: T1 General + NOA).

- Optional P&L and invoices or platform payout summaries.

So Which Is “Better”?

- Choose pay stubs when the reviewer needs payroll‑level detail and YTD.

- Choose bank statements when the reviewer prioritizes cash flow and deposit regularity.

- Choose both when you need detail and proof of receipt, or when requested explicitly.

How We Work (Intake → Reconciliation → Formatting → Delivery)

1) Intake

You securely provide your original documents—pay stubs, bank statements, tax forms, and any instructions from the requester. We’ll confirm the scope and timelines.

2) Reconciliation

We review for completeness, page order, and obvious export issues. If something is missing (e.g., page 2 of a statement), we let you know so you can supply it. We never fabricate missing pages.

3) Formatting & Accessibility

- Fix broken exports, misaligned tables, and rotated pages.

- Add bookmarks, labeled sections, and a short cover sheet listing included documents.

- Apply lawful redactions. We keep final files readable and accessible.

4) Delivery

We package your final PDFs and provide simple version names (e.g., Lastname_IncomePacket_Aug2025.pdf). If you need process details, see about our process.

What We Won’t Do

- Change any amounts, dates, or parties.

- Insert or remove transactions, deposits, or paycheck lines.

- Create “templates” that mimic banks, payroll, or government forms.

For a quote, check our pricing and turnaround options, or contact our team.

Quick Compliance Checklist & Packaging Tips

- Ask first: Confirm exactly which documents and how many months are required.

- Match names: The name on the documents should match your application ID.

- Show recency: Provide the latest pay period and current statements.

- Keep continuity: Include all pages—especially “This page intentionally left blank” pages.

- Verify math: YTD lines on stubs should reconcile with prior stubs and deposits.

- Package neatly: One PDF with bookmarks beats a scattered set of uploads.

- Protect data: Redact unneeded account digits while leaving enough for verification.

Need help with neat, policy‑friendly packaging? Our bank statement formatting keeps everything clear without changing facts.

Common Red Flags That Trigger Rejections

- Mismatched employer names, addresses, or pay periods across documents.

- YTD not reconciling with prior pay stubs.

- Deposit amounts that don’t match net pay on stubs.

- Unnatural fonts, pixelated logos, or uneven baselines from heavy image edits.

- Missing statement pages or page numbers out of sequence.

- Rounded figures where exact cents are expected.

- Inconsistent date formats within the same packet.

- Highlighter or markup that obscures key numbers.

Official Resources & Helpful Links

- United States — CFPB guidance on documents for mortgage and home‑buying (official resource): consumerfinance.gov/owning-a-home

- United Kingdom — HMRC SA302 tax calculation (often used for self‑employed proof): gov.uk/sa302-tax-calculation

- Canada — CRA Notice of Assessment information: canada.ca … Notice of Assessment

Internal help on FinancialDocsProvider.com:

Note: We are not a law firm and do not provide legal advice. This article is general information.

FAQs

Is a pay stub or a bank statement better for proof of income?

It depends on who’s asking and how you’re paid. Pay stubs show payroll‑level detail and YTD totals; bank statements show actual deposits and cash flow. Many reviewers ask for both.

How many months of bank statements do I need?

Two to three months is common for rentals; mortgages or business loans may request more. Always follow the requester’s written instructions.

Will screenshots be accepted?

Some institutions accept screenshots, but many prefer full PDF statements downloaded from your bank. When allowed, we can package screenshots into a readable PDF without altering content.

What if my income varies each month?

Provide a longer history of deposits plus tax forms (e.g., 1099, SA302, NOA) and, if available, a simple summary that points reviewers to consistent patterns.

Can you fix mistakes on my pay stub?

We can correct formatting glitches from bad exports and improve readability. Only your employer/payroll provider can correct factual errors like hours, rates, or totals.

Add comment