Last updated: August 2025

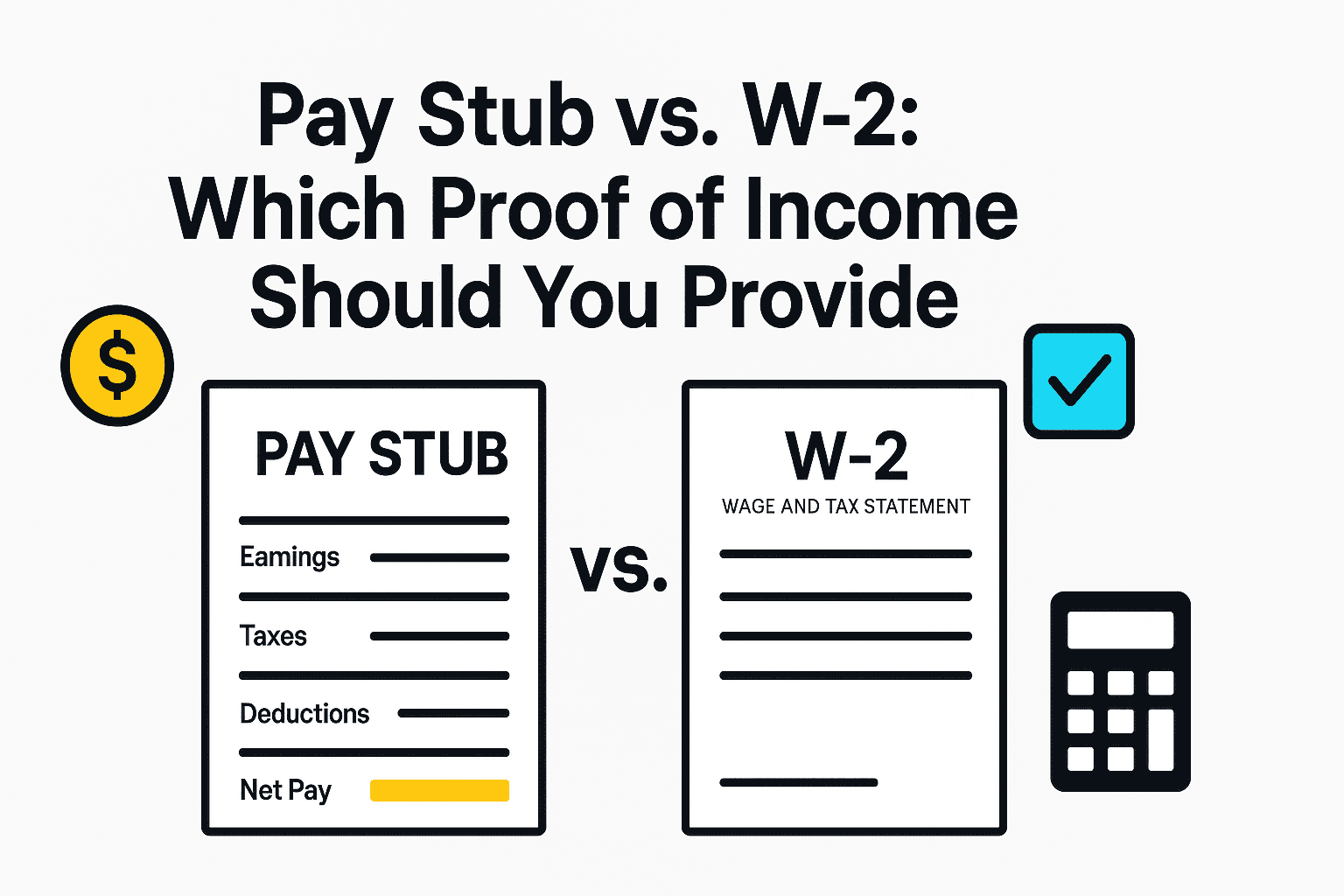

Whether you’re applying for an apartment, a car loan, or a business line of credit, the reviewer will ask for proof of income. For employees, that usually means choosing between recent pay stubs and the annual W‑2. If you’re deciding on Pay Stub vs W‑2 proof of income, this guide explains what each document shows, who typically requests them, and when to submit both for a smoother approval.

What if you’re self‑employed or based in the UK or Canada? We cover the equivalent documents, how they’re used, and the role professional formatting plays. Our goal is to help you present accurate information clearly while staying well within legal and compliance boundaries. :contentReference[oaicite:0]{index=0}

As a cross‑border service supporting clients in the US, UK, and Canada, FinancialDocsProvider.com follows a strict compliance‑first approach. We format, organize, and package your financial documents so they look professional and are easy to verify. We never fabricate data—doing so may constitute fraud. Instead, we improve legibility, redact sensitive details, and ensure your paperwork matches what underwriters expect to see.

Related Entities & Terms

- Pay stub, payslip, paycheque

- W‑2 (US wage & tax statement)

- 1099‑NEC and 1099‑MISC (US self‑employment slips)

- P60 and P45 (UK year‑end tax forms)

- T4 and T4A (Canada statements of remuneration)

- NOA (Notice of Assessment)

- CFPB, FTC and IRS (US regulators)

- FCA and HMRC (UK regulators)

- FCAC and CRA (Canadian regulators)

- Mortgage lenders, landlords, auto finance companies

Throughout this article we break down the key differences among these documents, when to use each one, and how to assemble a professional package. We also link to official government resources and related posts—such as our comparison of pay stubs vs. bank statements and our guide to creating legal self‑employed pay stubs. By the end, you’ll know exactly which proof of income to provide and how to present it for a fast, compliant review.

What are the legal basics for proof of income documents?

Short answer: A pay stub shows how one paycheck is calculated; a W‑2 summarizes your yearly wages and taxes. International equivalents (UK P60, Canada T4) serve the same year‑end purpose. If the decision is Pay Stub vs W‑2 proof of income, most lenders prefer both because each verifies something different.

The law treats proof of income as an official record. In the US, a pay stub summarizes gross pay, taxes withheld, and other deductions for a specific pay period. The W‑2 is a federal tax document employers must provide to employees and the IRS; it reports annual wages and the taxes withheld for the entire year.

In the UK, employers must issue payslips that display gross pay, deductions such as tax and National Insurance, and the net amount paid. At year‑end they issue a P60 summarizing total pay and tax paid across the tax year. In Canada, pay stubs list your regular pay, one‑off payments, and allowances, while your T4 slip serves as the official Statement of Remuneration with annual income and deductions.

For self‑employed workers, US clients issue 1099 forms to report non‑employee compensation, and taxes are not usually withheld. Canada’s T4A plays a similar role for contractor payments. Regardless of jurisdiction, altering numbers or producing forged forms can lead to serious charges (e.g., bank or wire fraud). The safest route is to provide authentic paperwork and, if needed, hire a reputable service to format documents without changing the facts.

Key takeaway: Pay stubs show the earnings and deductions for each pay period. W‑2s, P60s, and T4s summarize annual wages and taxes. Self‑employed workers rely on 1099s, T4As, invoices, and bank records. All of these are legal records—altering them is illegal.

Which edits are allowed when formatting proof of income?

Short answer: You can improve clarity without changing facts. Lenders and landlords welcome legible, well‑organized documents, provided the underlying numbers, dates, and names remain untouched.

Before submitting your documents, it’s common—and smart—to tidy them up. Clear, consistent formatting reduces questions and prevents avoidable delays. The following edits are typically acceptable because they improve readability without altering substance:

- Redaction of sensitive data: You may redact Social Security numbers, National Insurance numbers, or bank account numbers for privacy. Leave partial digits visible so the document remains verifiable.

- Highlighting and annotation: It’s fine to highlight key figures (net pay, year‑to‑date totals) or add a brief note guiding the reviewer. Keep annotations factual and non‑persuasive.

- Reformatting for clarity: Combine multiple pay stubs into one PDF, convert image files to PDF, rotate pages, crop excess margins, and enhance resolution. These steps help reviewers read your file quickly.

- Translating currency or units: If you’re applying internationally, include a separate conversion note showing an approximate equivalent in the new currency. Do not overwrite the original amounts.

- Organising multi‑document packets: Assemble pay stubs, tax forms, and supporting statements into a single, labeled packet. Add a brief cover page and table of contents for easy navigation.

At FinancialDocsProvider.com, we specialize in these compliance‑safe tasks. Our proof of income editing service improves clarity and presentation only. We do not change amounts, pay dates, or payee names; we simply make your existing information easier to read. Need a price? Visit our pricing page. For bank statement formatting, see Is editing a bank statement legal?

Example: A tenant applying in another country includes three US pay stubs and a short currency conversion note on the cover page. The original stubs remain untouched. The landlord can verify net pay on the stubs while understanding the approximate value in local currency.

What edits are illegal and what are the consequences?

Short answer: Any change that misrepresents income, employer details, or dates is off‑limits. Creating or using fake documents can lead to fines, denial of credit, and even criminal charges.

Altering financial documents to inflate income or hide gaps is risky and often illegal. In many cases, using fake pay stubs or W‑2s is treated as fraud. Consequences may include fines, restitution, loss of credit access, and possible prison time. Similar risks exist in the UK and Canada for forging payslips, P60s, T4s, or other official forms.

Specifically, avoid:

- Changing numbers: Adjusting gross pay, taxes, year‑to‑date amounts, or net pay to meet a threshold is fraud. Pay stubs must reflect actual earnings.

- Manipulating dates or pay periods: Back‑dating or forward‑dating to show continuous employment or “recent” pay stubs is a form of forgery.

- Fabricating entire documents: “Generator” tools that produce pay stubs or W‑2s from invented data are commonly used for fraud. Using them can trigger serious penalties and blacklisting by lenders.

- Altering employer or employee details: Changing names, addresses, tax IDs, or job titles to disguise gaps or claim a different role is deceptive and unlawful.

- Deleting or hiding deductions: Removing taxes, pension, or insurance deductions to inflate net pay misrepresents your real compensation.

Practical risk: Even if a forged document slips past an initial review, verification teams often contact employers, compare tax forms, or request bank statements. Any mismatch can lead to denial and potential reporting to authorities. The safe approach is always the honest one.

When do you need professional document formatting?

Short answer: Use pay stubs for current income and employment details; use W‑2s, P60s, or T4s for annual totals. For many applications—especially mortgages and long‑term leases—submit both. If you’re self‑employed, use 1099s or T4As plus invoices and bank records.

Choosing the right proof of income depends on your goal and employment status. Below are common scenarios, the documents reviewers expect, and simple ways professional formatting can reduce follow‑up questions.

Renting a home or apartment

Landlords often ask for your two or three most recent pay stubs because they show current income, hours, and deductions. Many will also request a W‑2 to confirm your annual income and employment continuity. In the UK, a recent payslip plus your P60 for the previous tax year may be acceptable. In Canada, landlords may accept a T4 slip or Notice of Assessment alongside your latest pay statements.

What to submit:

- Two to three recent pay stubs (or payslips) covering at least one full month of pay.

- Your latest W‑2, P60, or T4 to verify annual totals.

- A letter from HR confirming your position and base pay (if available).

- Optional: A brief cover page summarizing net pay and contact details for verification.

Mini‑scenario: You recently switched jobs mid‑year. Submit your new employer’s pay stubs and last year’s W‑2. Add a short note explaining the transition date so monthly amounts don’t appear inconsistent.

Mortgage and auto loan applications

Underwriters need a full picture of your capacity to repay. They often request two years of W‑2s or T4s plus recent pay stubs to calculate debt‑to‑income ratios. Self‑employed borrowers should include 1099s or T4As, tax returns, and a year‑to‑date profit‑and‑loss statement, supported by recent bank statements.

What to submit:

- Two years of W‑2s (US) or T4s (Canada), or a recent P60 (UK) with payslips.

- Most recent 30–60 days of pay stubs or a longer run if paid bi‑weekly.

- Self‑employed: two years of tax returns, 1099/T4A forms, P&L, and bank statements.

- Any bonus/commission statements with clear year‑to‑date totals.

Mini‑scenario: You earn commission that varies month to month. Highlight the YTD commission on your stubs and include last year’s W‑2 or T4. Add a short explanation of how commission is calculated and paid.

Small business or SBA loans

SBA and bank small‑business lenders expect comprehensive documentation. A pay stub alone rarely suffices. You’ll likely need W‑2s for employees, 1099s for contractors, corporate tax returns, and financial statements. Consistency across forms is critical.

What to submit:

- W‑2s for employees and 1099s/T4As for contractors.

- Business tax returns and signed financial statements.

- Payroll reports that reconcile to W‑2 totals.

- Bank statements showing deposits that align with revenue claims.

Mini‑scenario: Your business uses multiple payroll providers over the year. Include a reconciliation summary that ties all W‑2 wages back to the general ledger and bank deposits. This avoids extra requests.

Immigration and visa applications

Immigration authorities often require stable, verifiable income over a defined period. A Canadian T4 or UK P60 demonstrates tax paid, while US applications may request your latest W‑2 and several pay stubs. Make sure names, addresses, and dates align exactly across all paperwork.

What to submit:

- Year‑end forms (W‑2, P60, T4) that match your current employment.

- Several consecutive pay stubs to prove ongoing income.

- Bank statements showing payroll deposits, if requested.

- Any official letters specified by the immigration program.

Mini‑scenario: Your legal name recently changed. Update HR and payroll first, then obtain new pay stubs and a corrected letter from HR before applying. Mismatched names are a common cause of delays.

Self‑employed and freelance workers

If you’re self‑employed, you won’t receive a W‑2. US clients issue 1099s; Canadian clients may issue T4As. You’re responsible for calculating and paying your own taxes. Keep detailed invoices and bank records, and consider adding an accountant’s letter summarizing your income and expenses.

What to submit:

- 1099 (US) or T4A (Canada) forms, plus invoices and contracts.

- Two years of personal and, if applicable, business tax returns.

- A current, signed profit‑and‑loss statement with matching bank activity.

- Optional: A summary page mapping deposits to invoice numbers for easy verification.

Mini‑scenario: You receive payments through multiple platforms. Export payout histories, cross‑reference them to invoices, and include a one‑page index. This helps underwriters tie deposits to real revenue.

How does FinancialDocsProvider.com work?

Short answer: We tidy and package your existing documents—no data changes, ever. The outcome is a clean, verifiable packet that answers underwriter questions before they arise.

Our process is simple and transparent. It’s designed to keep your documentation compliant while improving readability and flow from the reviewer’s perspective.

- Intake and consultation: Tell us what you need—pay stub formatting, W‑2 compilation, or a complete proof‑of‑income packet. We explain scope, timing, and provide a clear quote. You can contact our team anytime.

- Document upload: You upload existing documents through our secure portal. We never ask for personal passwords or direct account access; you always control your data.

- Reconciliation and cross‑check: We review your files for internal consistency. Pay dates, amounts, and employer details should align across pay stubs, tax forms, and letters. If something looks off, we flag it for you to address.

- Formatting and packaging: We clean scans (crop, rotate, enhance resolution), add page labels, and redact sensitive data. On request, we include a summary page with key figures and contact details for verification.

- Delivery and revisions: You receive a neat PDF packet ready to submit. If you need adjustments or additional copies, we provide them promptly and keep your files confidential.

What you get: A professional‑looking, logically ordered package that mirrors how underwriters think. The presentation reduces back‑and‑forth, which often speeds up decisions.

What is the compliance checklist?

Short answer: Gather the right documents, confirm internal consistency, redact sensitive data, and present a clear, chronological packet. If you’re self‑employed, attach tax returns and a current P&L with bank support.

Before submitting any proof of income, run through this checklist to avoid delays or rejections:

- Gather the right documents: Employees should collect the last 2–3 pay stubs and the most recent W‑2 (US), P60 (UK), or T4 (Canada). Self‑employed applicants need 1099/T4A slips, invoices, bank statements, and tax returns.

- Verify consistency: Confirm that year‑to‑date figures on your pay stubs reconcile to annual totals on your W‑2 or T4. Employer names and addresses should match across forms.

- Check gross vs. taxable income: Your pay stub’s gross wages can differ from W‑2 taxable wages due to pre‑tax deductions. Be ready to explain any differences with a short note.

- Inspect deductions: Review taxes, pension contributions, and insurance. Make sure nothing appears unusual or missing.

- Redact sensitive data: Conceal Social Security numbers, National Insurance numbers, and bank account details, leaving only the last few digits visible.

- Organize chronologically: Present pay stubs oldest to newest. Place tax forms after the stubs, followed by supporting documents.

- Include support documents: Self‑employed applicants should attach a current P&L, copies of 1099/T4A forms, and an accountant’s letter if available.

- Use clear, legible scans: Avoid angled photos or low‑resolution images. Use a scanner app or let us enhance the images for clarity.

- Provide contact details: Add an HR or payroll contact for verification. For contractors, list the primary client’s payment or HR contact.

- Add a brief summary page: A one‑page overview with net pay, YTD total, and document list helps reviewers find answers fast.

Tip: If you changed jobs mid‑year, add a one‑paragraph note stating the change date and whether benefits shifted. This preempts questions about apparent dips or jumps in taxable wages.

What are common red flags that trigger rejections?

Short answer: Inconsistencies are the number‑one cause of rejections. Mismatched totals, unreadable scans, unusual formatting, or missing deductions can all stall or sink an application.

Underwriters and landlords look for a clean, coherent story told by your documents. These pitfalls often lead to document rejections:

- Mismatched totals: Year‑to‑date amounts on pay stubs should reconcile with annual totals on your W‑2 or T4. Large discrepancies invite extra scrutiny.

- Inconsistent employer information: Employer names, addresses, and tax IDs should match across pay stubs, W‑2s, and letters.

- Unreadable scans: Blurry, dark, or crooked images slow verification and may be rejected. Provide high‑resolution, full‑page scans.

- Unusual formatting: Multiple mismatched fonts, misaligned columns, or missing logos can raise suspicion. Use original layouts and professional formatting, not DIY edits.

- Missing deductions: Legitimate pay stubs include taxes and other deductions. Their absence may suggest fabrication.

- Unexplained gaps: Gaps in pay periods or missing months of income raise concerns. Provide a brief explanation with supporting documents where possible.

- Non‑matching names: Name changes not reflected across HR letters, pay stubs, and tax forms cause avoidable delays.

- Odd pay cycles: Sudden switches from weekly to monthly pay, without explanation, can look suspicious. Add a note if the employer changed pay schedules.

Fix it fast: If one of these issues applies to you, address it proactively. A short, factual letter from HR, payroll, or your accountant can resolve many concerns before they become roadblocks.

Where can you find more resources?

Short answer: Use official sources for definitions and requirements, and consult our in‑depth guides for formatting and packaging best practices. The links below are a good starting point.

- IRS: About Form W‑2 – Employer duties and how the W‑2 reports annual wages and taxes.

- GOV.UK: Payslips – What must be included on UK payslips, including gross wages, deductions, and net pay.

- GOV.UK: P60 guide – How the P60 summarizes tax paid and serves as proof of income.

- Canada.ca: Check your pay stub – How gross pay is calculated and common deductions.

- FreshBooks: T4 vs. T4A – Overview of T4 and T4A slips and their differences.

- Is Editing a Bank Statement Legal? – Our guide to bank statement editing and legal considerations.

- Pay Stub Formatting Mistakes – Common errors and how to avoid them.

- Pay Stub Proof of Income: Real Customer Stories – How document formatting helps in real‑world scenarios.

If you need tailored guidance or editing help, explore our financial document services or contact us directly via our contact form.

FAQs

Is a pay stub the same as a W‑2?

No. A pay stub is issued with each paycheck and shows the earnings, taxes, and deductions for that pay period. A W‑2 summarizes your annual wages and taxes withheld and is filed with the IRS. You often need both for loans or housing.

Can I submit pay stubs instead of a W‑2?

Sometimes. For short‑term verifications, recent pay stubs may suffice. However, many lenders and landlords also want your W‑2, P60, or T4 to verify annual income. The pay stub reflects gross pay, whereas the W‑2 reflects taxable wages after pre‑tax deductions. Providing both reduces the risk of rejection.

What if I’m self‑employed and don’t receive a W‑2?

Self‑employed individuals receive 1099 forms from clients, or T4A slips in Canada. These do not include tax withholdings, so you must calculate and pay your own taxes. Provide your 1099/T4A slips, invoices, bank statements, and a profit‑and‑loss statement as proof of income.

Are online pay stub generators legitimate?

Be cautious. Some services help employers create pay stubs based on real payroll data, but many tools are used to fabricate income. Creating fake pay stubs can lead to serious consequences, including fraud charges. Always use your actual payroll records or work with a reputable service like ours to format real documents.

How long should I keep pay stubs and W‑2s?

Keep pay stubs for at least one year, until you reconcile them with your W‑2. Keep W‑2s for at least seven years for audit purposes. In the UK, keep P60s and payslips for at least 22 months; in Canada, retain T4 slips and related records for six years.

Need accurate, reliable financial documents fast? Contact FinancialDocsProvider.com now.

About the author: Our editorial team specializes in financial document compliance across the US, UK, and Canada. We help renters, loan applicants, and business owners present their income accurately and legally. Learn more on our About Us page.

Add comment