Introduction

By FinancialDocsProvider.com Editorial Team

Last updated: August 2025

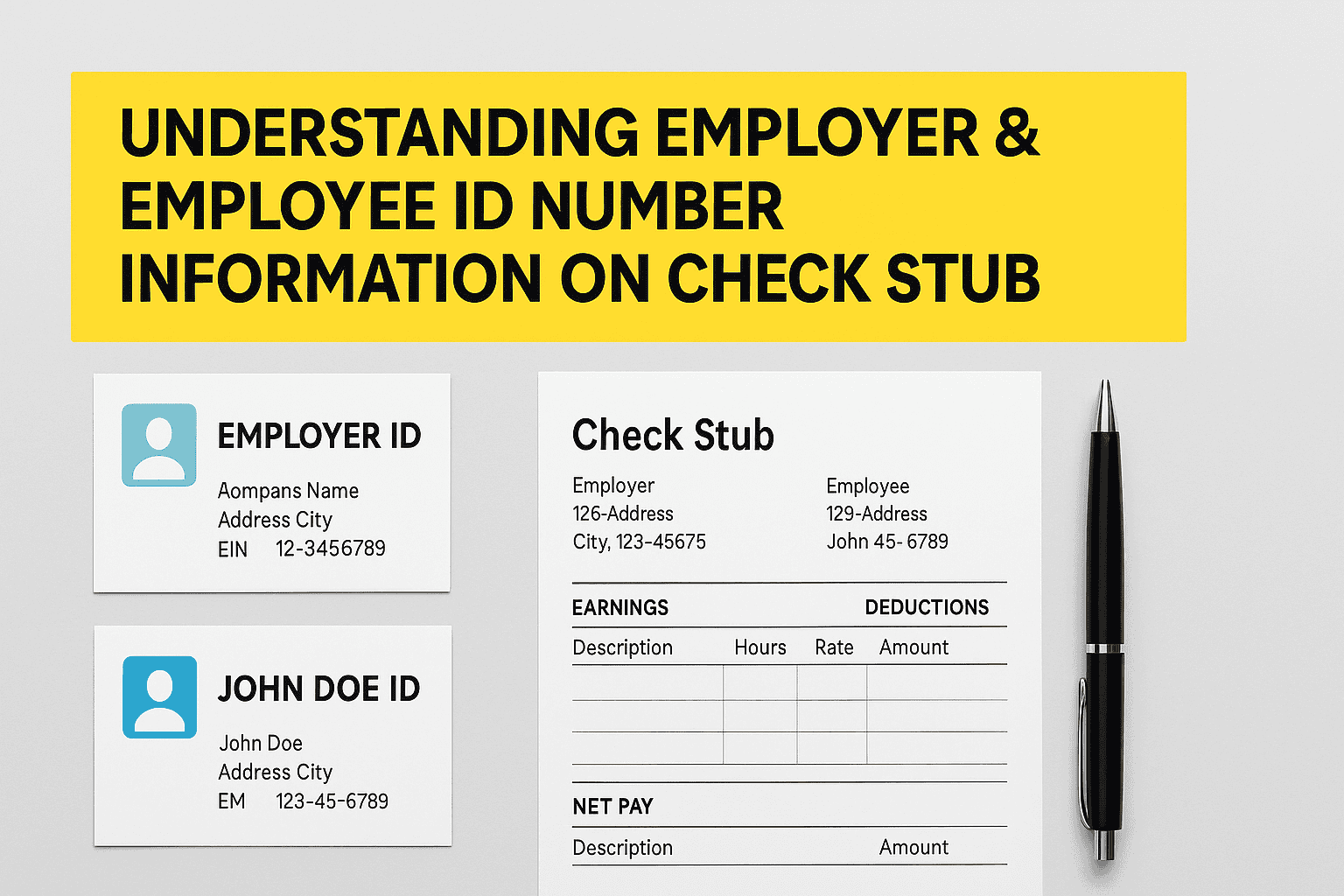

The small strings of numbers on a pay stub or payslip carry big weight. The check stub employer ID connects a payment to a real business for tax and payroll purposes, while the employee number links the payment to you. Lenders, landlords, and verifiers rely on these identifiers to confirm that the documents you submit belong to an actual payroll and to the right person.

This guide explains how employer and employee IDs appear in the US and UK, how to read them, and how to package documents so reviews go smoothly. Our role is editorial: we format, organize, and improve legibility. We do not fabricate or change facts. If a digit is wrong because of a payroll input error, we flag it for correction by the issuer—never “fix” it ourselves.

Need help preparing a clean, reviewer‑friendly packet? Explore our proof of income editing and bank statement formatting. For budgets and timelines, see our pricing or about our process.

Related Entities & Terms

- US: Employer Identification Number (EIN), Taxpayer Identification Number (TIN), Form W‑2, 1099‑NEC

- UK: PAYE reference, National Insurance (NI) number, P60/P45, HMRC

- Canada (context): T4/T4A, Notice of Assessment (NOA), CRA, FCAC

- Regulators & watchdogs: IRS, CFPB, FTC (US); FCA & GOV.UK (UK)

- Documents: pay stubs (US), payslips (UK/CA), employment letters, payroll registers

- Verification: income & employment verification, tenant screening, underwriting

- Security: redaction, PII masking, watermarking, access controls

- Payroll terms: gross vs net pay, YTD totals, deduction codes, pay period dates

Law & Compliance Basics (US & UK)

United States: EIN, W‑2, and payroll records

In the US, the employer’s unique identifier for federal tax purposes is the EIN. It is used for payroll filings and appears on forms like the W‑2. Some payroll stubs list the EIN on the header or company info block, while others show only the employer name and address; both are acceptable as long as the employer can be matched to official records. Employees may also see an internal “Employee ID” or “Payroll ID” that is specific to the company and not a government number.

To understand EIN requirements, see the IRS’s guidance on Employer Identification Numbers and the online resources for obtaining or validating EIN‑related information at IRS.gov. For withholding and year‑end reporting, the W‑2 provided by your employer must accurately reflect the employer’s EIN and your personal data.

United Kingdom: PAYE reference & NI number

In the UK, employers operate PAYE (Pay As You Earn). Payslips typically include the employer’s PAYE reference and the employee’s National Insurance (NI) number. These identifiers tie the payment to tax and social security contributions. Official guidance on PAYE for employers and payslip content is available on GOV.UK. You should never substitute or “pad” these values to satisfy a request; if a number is missing, ask payroll or HR to reissue a corrected document.

Privacy and limited redaction

Redaction for privacy is common and lawful when the receiving party accepts it. Examples include masking part of an NI number on a UK payslip or limiting the display of an employee ID so the packet can be shared safely with landlords or brokers. However, changes must not mislead the recipient. If a reviewer demands full identifiers, provide them securely rather than editing digits on existing documents.

Key principle across both markets: formatting and legibility are fine; altering facts is not. If information is wrong, the issuer (employer or payroll provider) must fix it and reissue the document.

What Edits Are Allowed (helpful, factual, and safe)

Redaction patterns that reviewers accept

- Masking middle digits of NI or internal Employee ID (e.g., “QQ 12•• 34•• C”).

- Showing only the last 3–4 digits of an internal payroll number where permitted.

- Adding a small note, “Redacted for privacy—full ID available on request.”

Legibility and structure

- Aligning columns so employer details, IDs, and YTD totals are readable.

- Fixing page breaks, headers, and table borders on multi‑page stubs/payslips.

- Embedding searchable text (OCR) for underwriters who need to copy values.

Export cleanup & packaging

- Combining several pay periods into one PDF with bookmarks and a contents page.

- Adding a one‑page “Income Summary” that lists pay frequency, employer details, and where IDs appear—without changing data.

- Cross‑referencing bank deposits that match each pay date. We can help with proof of income editing and bank statement formatting.

What’s Illegal (and high risk)

Any change that misrepresents identity, amounts, or timing can be treated as falsification. Do not:

- Swap or invent an employer EIN, PAYE reference, or NI number to “make it match.”

- Edit the employee number to impersonate someone else or hide a mismatch.

- Alter pay dates, hours, rates, gross/net amounts, or YTD totals.

- Manipulate bank statements to insert deposits that never occurred.

Consequences range from application denial to account closure and potential civil or criminal exposure. In the US, payroll and tax misstatements can trigger penalties under IRS rules; in the UK, providing false information to obtain credit or tenancy can violate fraud laws. When you spot an error, ask payroll/HR to correct and reissue the document. We will never “fix” facts—only the formatting around them.

Use Cases: check stub employer ID & employee number in action

Below are practical situations where correct IDs and clean presentation speed up approvals in the US and UK.

Renter moving to a new flat/apartment

Scenario: A London renter submits three recent payslips; the letting agent asks for an employer’s PAYE reference and the tenant’s NI number to verify employment. One payslip shows the NI in a faint font and the PAYE reference on page 2.

- Combine the three payslips into one PDF with a simple contents page.

- Enhance legibility so the PAYE reference and NI number are crisp and searchable.

- Add a cover sheet listing the employer’s name, PAYE reference location, and the tenant’s NI number location.

- Redact middle digits of NI if allowed by the agent; keep a full, unredacted copy ready for secure submission if requested.

Outcome: The agent quickly finds what they need, reducing back‑and‑forth and the risk of rejection for “incomplete information.”

Auto loan underwriter (US)

Scenario: A borrower in the US submits six weeks of pay stubs to a lender. The stubs list the employer’s name but not the EIN on the face of the stub; the W‑2 does show the EIN.

- Provide 2–4 recent pay stubs plus last year’s W‑2 showing the employer’s EIN.

- On a one‑page summary, note: “Employer EIN present on W‑2 (Box b); stubs list employer name and address.”

- Include bank deposits that match pay dates and net amounts.

Outcome: The underwriter can cross‑reference employer identity via the W‑2 and reconcile net pay via deposits.

Small‑business owner paying themselves

Scenario: A US S‑Corp owner pays themselves via payroll. The lender asks for employer and employee identifiers on recent stubs plus tax forms.

- Ensure the payroll software is configured with the correct EIN and legal entity name.

- Export recent stubs, confirm the employer block is consistent across all pages, and that the W‑2/W‑3 filings match.

- Create a short cover sheet explaining the owner’s role and compensation method (regular payroll vs occasional draws).

Outcome: The lender has a clear, documented link from entity (EIN) to payroll to personal income.

Work visa or immigration check (UK)

Scenario: An applicant’s payslips must show their NI number and employer information. The employer name changed after a merger, and older payslips use the former name.

- Include a contemporaneous employer letter explaining the merger and continuity of the PAYE reference.

- Present payslips in chronological order and label the point at which the name changes.

- Use a note on the cover page to indicate where to locate the NI number on each payslip.

Outcome: Reviewers understand the name change and can match all documents to the same employer reference.

US contractor (1099) proving income without “employee ID”

Scenario: A 1099 contractor doesn’t have pay stubs or an Employee ID. The lender wants consistent identifiers.

- Provide invoices, 1099‑NEC forms, and bank deposits that match invoice numbers.

- Create a simple index mapping invoice IDs to bank credits by date and amount.

- If using a payment platform (e.g., payroll service for contractors), include the account profile page showing the payer’s information and TIN where available.

Outcome: The lender sees reliable, document‑to‑deposit trails even without an employee number.

Where to find these fields on common layouts

- US pay stubs: employer name/address at top; EIN may appear near the company block or not at all (rely on W‑2 if absent); employee number often in a header row; pay period dates on the first page.

- UK payslips: employer name/logo and PAYE reference near the header or footer; NI number typically alongside employee info; tax code and period number shown prominently.

- W‑2: employer EIN in Box b; employee SSN may be truncated on copies for privacy—submit full SSN only through secure channels if specifically required.

- P60/P45: shows employer information for the tax year and may be used to corroborate identity and totals on payslips.

Mini checklists you can follow today

US packet (tenant or loan)

- Gather last 2–4 pay stubs and the most recent W‑2.

- Confirm employer details are consistent; note whether the EIN is on the stubs or only on the W‑2.

- Export 1–2 months of bank statements showing matching payroll deposits.

- Assemble a cover page: employer name, (EIN location), pay frequency, and where to find the employee ID.

- Redact only what the reviewer allows. Keep an unredacted version ready for secure transfer upon request.

UK packet (lettings or credit)

- Gather 3 recent payslips plus your P60 if available.

- Check that the payslips list the PAYE reference and your NI number; if either is missing or unreadable, ask payroll to reissue.

- Include bank transactions that align with payday and net amounts.

- Make a brief summary page: employer details, PAYE reference location, NI number location, gross/net and YTD.

Want us to package this for you—without changing any facts? Review our services and pricing, then contact our team.

How We Work (intake → reconciliation → formatting → delivery)

1) Intake

Upload pay stubs/payslips, W‑2 or P60/P45, and relevant bank statements. We accept PDFs, scans, and exports. If your payroll system produces multiple files per period, send them all—we’ll organize.

2) Reconciliation

We cross‑check names, dates, and identifiers across documents. If a stub lists the former employer name but your W‑2 shows the new legal name, we annotate the packet so reviewers understand the continuity.

3) Formatting

We standardize fonts and spacing, fix page breaks, and add bookmarks. We bring faint ID lines up to readable contrast but never alter the digits. We also add a cover page with a concise map: where to find each identifier and how pay periods align with deposits.

4) Delivery

You receive a clean, single PDF ready for upload. We include one round of light revisions for layout (not facts). If a factual correction is needed, we direct you to the issuer to reissue the document.

Curious about turnaround time or scope? See our pricing and about our process.

Quick Compliance Checklist

- Match identifiers: employer name ↔ EIN/PAYE; person ↔ employee number/NI.

- Use official totals: align gross/net and YTD across stubs and annual forms (W‑2, P60).

- Explain anomalies: mergers, rebrands, or payroll vendor switches—add a brief note or employer letter.

- Redact carefully: only what the reviewer permits; label redactions.

- Reconcile deposits: payroll credits should match dates and net pay; annotate split deposits.

- Accessibility: ensure documents have searchable text; avoid photos of screens.

- Never alter facts: if digits are wrong, ask payroll to reissue.

Red Flags That Trigger Rejections

- Missing or unreadable IDs: faint NI numbers or cropped EIN lines.

- Inconsistent legal names: the employer block differs across documents with no explanation.

- Weird ID formats: NI numbers not following the typical pattern; EINs with the wrong number of digits.

- Out‑of‑order packets: payslips not chronological; page 2 missing where the PAYE reference appears.

- Net pay mismatch: deposits that don’t reconcile to net amounts without a note.

- Over‑redaction: masking so much that reviewers can’t validate.

Most red flags are avoidable with solid formatting and a short cover page that points reviewers to the exact fields they care about.

Resources

Official guidance

- United States — IRS: Employer Identification Numbers (EIN)

- United Kingdom — GOV.UK: PAYE for employers

- United States — CFPB: Consumer Financial Protection Bureau (general consumer finance resources)

Helpful internal links

- Fact‑preserving proof of income editing

- Clean, readable bank statement formatting

- Transparent pricing

- Questions? contact our team

- Learn more about our process

FAQs

Where do I find the employer ID on a US pay stub?

Some stubs show the EIN near the employer’s name; others omit it. If it’s not on the stub, use your W‑2 (Box b) to supply the EIN. Never insert digits yourself—use official documents.

Is my employee number the same as my Social Security or NI number?

No. An employee or payroll ID is an internal company identifier. Social Security (US) and NI (UK) numbers are government identifiers. Do not interchange them on documents.

Can I redact parts of my NI or employee number?

Often yes, if the reviewer accepts partial redaction. Label the redaction and keep a full, unredacted copy ready for secure delivery on request.

What if the employer name changed after a merger?

Include an employer letter explaining the change, keep payslips in order, and show continuity of the PAYE reference or EIN across documents.

Can you change the numbers on my pay stub or payslip?

No. We never alter facts such as IDs, amounts, or dates. We only format, organize, and reconcile documents to present accurate information clearly.

Need accurate, reliable financial documents fast? Contact FinancialDocsProvider.com now.

Add comment