- Introduction: Why pay stub authenticity matters across the US, UK and Canada; how this guide helps; key entities and terms.

- Legal basics: The definition of a pay stub, regulatory requirements in each country, and why formatting differs from falsifying.

- Allowed edits: Practical examples of permissible formatting, redaction and export fixes; includes a Compliance Snapshot.

- Illegal edits: Actions that change factual information, potential fraud consequences and how verification tools catch fakes.

- Use cases: When professionally formatted pay stubs are needed—rentals, auto loans, SBA loans and self‑employment situations.

- How we work: Step‑by‑step overview of FinancialDocsProvider.com’s intake, reconciliation, formatting and delivery process.

- Checklist: Comprehensive checklist of what belongs on a pay stub in each jurisdiction, plus packaging tips.

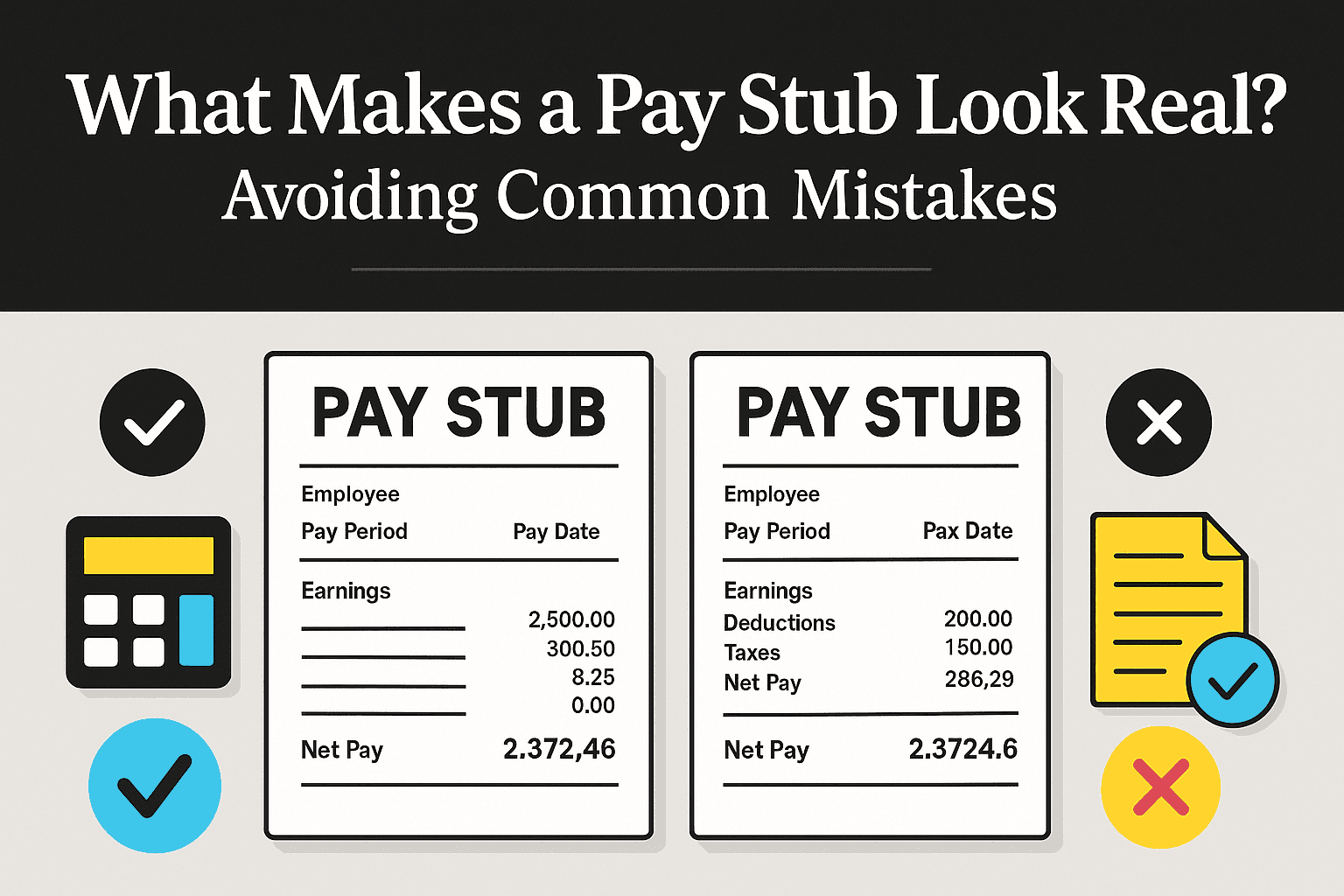

- Red flags: Common mistakes that make stubs look fake, including mismatched data, poor layouts and metadata issues.

- Resources: Links to official regulators and additional FinancialDocsProvider.com articles for deeper learning.

- FAQs: Answers to common questions about pay stub authenticity, legality of edits, number of stubs needed and more.

- Call to Action & Bio: Closing invitation to contact FinancialDocsProvider.com and a short author bio.

Last updated: August 2025

Whether you’re applying for an apartment in Chicago, securing an auto loan in London, or self‑employed in Toronto, you’ll likely be asked for pay stubs. But what makes a pay stub look real, and how do you avoid the small errors that trigger rejections? This guide answers those questions for the US, UK, and Canada with a compliance‑first, no‑fabrication approach.

We focus on clarity, legality, and professional presentation. You’ll learn how to make a legitimate pay stub easier to verify—without changing facts—and how to package supporting documents so reviewers can say “yes” faster.

Below is a quick reference list of key entities, terms, and documents you’ll encounter in this article.

Related Entities & Terms

- Pay stub / payslip / pay cheque / remittance advice

- Forms: W‑2, 1099‑NEC/1099‑MISC (US); P60, P45, SA302 (UK); T4, T4A, Notice of Assessment (NOA) (CA)

- Gross vs net pay; year‑to‑date (YTD) totals; deductions & contributions

- Employer Identification Number (EIN), National Insurance (NI) number, Social Insurance Number (SIN)

- Regulators: IRS, CFPB & FTC (US); HMRC & FCA (UK); CRA & FCAC (Canada)

- Supporting documents: bank statements, employment letters, invoices, profit‑and‑loss statements

- Tech terms: PDF/A, optical character recognition (OCR), metadata

- Process terms: underwriting, income verification, affordability assessment, fraud detection

By the end, you’ll understand the difference between making a pay stub look real through proper formatting and illegally falsifying information. You’ll also know when to seek help from professionals like us.

What are the legal basics for making a pay stub look real?

A strong‑looking pay stub starts with the law. Across the US, UK, and Canada, regulators distinguish between formatting for clarity and falsifying facts. The former is allowed; the latter can be fraud. This section outlines the essentials and explains why “how it looks” must never override “what is true.”

A pay stub (also called a payslip or remittance advice) documents how your paycheck is calculated. In the US, employers generally provide statements showing gross wages, taxes withheld, and net pay; the IRS explains annual wage reporting via Form W‑2. In the UK, employers must issue payslips detailing gross pay and National Insurance deductions; HM Government’s payslip rules set minimum content. In Canada, employers issue pay statements and year‑end T4 slips describing remuneration, per the Canada Revenue Agency.

Facts on a pay stub—earnings, hours, withholdings, dates, employer details—are legal records. Altering those facts may constitute fraud or misrepresentation. Improving legibility, redacting sensitive identifiers, or converting formats is usually permitted. Our simple pay stub guide breaks down the anatomy of a compliant stub and where presentation upgrades are appropriate.

Jurisdiction snapshots:

United States. Employers commonly deliver digital pay statements through payroll systems. Some states mandate specific items (hours, rates, pay periods) and require employees to access or print stubs. W‑2s reconcile annual totals and are frequently requested alongside recent stubs.

United Kingdom. Employers must provide itemised payslips showing gross pay, variable pay items, and deductions. Many employers use Real Time Information (RTI) submissions to HMRC, so figures should align with internal payroll records.

Canada. Pay statements typically show CPP, EI, and tax deductions, plus YTD amounts. The year‑end T4 consolidates income and deductions and is often used to confirm totals.

Practical implications. You can re‑export or reorganise your files to aid review, but you cannot change numbers, dates, or parties. If a figure looks off, the only correct path is to reconcile it—never to “make it fit.”

Mini‑scenario: A tenant’s net pay deposit doesn’t match the pay stub by \$2.34 due to bank rounding on currency conversion. A short cover note explaining the conversion and a highlighted line in the bank statement resolves it—no edits to earnings or dates needed.

Which edits are allowed without altering facts?

The legal line is simple: if the underlying facts stay the same, improvements to presentation are generally fine. You can make a real pay stub easier to read, share, and archive. You cannot change earnings, dates, or parties. The examples below show permissible upgrades that improve legibility and privacy without touching the data.

Formatting & legibility improvements

- OCR and text‑layer fixes: Rotate sideways scans, de‑skew angled images, and add a searchable text layer so underwriters can copy figures precisely.

- Contrast and brightness adjustments: Light touch enhancements make faint scans readable without modifying content.

- File conversions: Converting HEIC or JPEG exports to standards like PDF/A ensures consistent rendering and helps preserve document integrity.

- Page sequencing: Combine multi‑page stubs into a single, bookmarked PDF so reviewers can jump to totals or YTD figures quickly.

- Consistent page labels: Add page numbers (e.g., “Pay Stub – May 15, 2025 – Page 1 of 2”) to avoid mix‑ups during underwriting.

Privacy & redaction

- Partial masking of sensitive IDs: Redact part of your SSN, NI, or SIN—e.g., “***‑**‑1234”—while leaving enough detail for identification.

- Hiding personal addresses: You may obscure your home address for safety. Do not remove employer details or pay period information.

- Removing bank account numbers: Mask direct‑deposit account digits to reduce identity‑theft risk.

Export & accessibility fixes

- Update fonts and alignment so labels and amounts line up cleanly.

- Add bookmarks, headings, and alt text so screen readers and assistive tools work correctly.

- Embed fonts and flatten layers to prevent corruption when files open on different devices.

- Include a brief “Notes” page if you must explain a legitimate anomaly (e.g., a one‑time retro pay adjustment).

Compliance Snapshot

Allowed edits (formatting only): Redacting sensitive identifiers, rotating or cropping pages, adjusting contrast, combining documents, converting to PDF/A, embedding fonts, adding bookmarks and alt text, adding descriptive page labels, and correcting legibility issues.

Illegal alterations: Changing earnings, hours, tax withholdings, dates, pay periods, employer names or account numbers; fabricating pages or logos; generating a stub from scratch without underlying records; and removing metadata to hide edits.

Before/after example: A contractor submits a photo of a crumpled payslip. We straighten it, convert to PDF/A, add a text layer, and mask the last four digits of the bank account. The math and dates remain unchanged—now reviewers can verify in seconds.

If you’re unsure whether an edit is permissible, our proof of income editing team can review your needs and advise on scope. A pay stub should mirror what’s already recorded in payroll, banking, and tax systems—nothing more, nothing less.

What edits are illegal and why?

Editing becomes fraud the moment it changes the truth. Inflating income, disguising a gap in employment, or misrepresenting the payor is unlawful in all three jurisdictions. Beyond denials, consequences can include civil liability and, in serious cases, criminal exposure.

Examples of prohibited changes

- Changing dollar amounts: Increasing gross or net pay, adding fictitious overtime or bonuses, or altering YTD totals.

- Manipulating dates: Backdating to cover an employment gap or shifting pay periods to appear more recent.

- Inventing employers or EINs: Using a fictional company or copying a real employer’s logo to fabricate employment.

- Adjusting deductions and tax codes: Reducing withholdings to boost net pay or using implausible tax codes.

- Removing negative information: Deleting lawful deductions (e.g., garnishments) or unpaid leave indicators.

Consequences & fraud detection

- Automated checks: Underwriting systems flag arithmetic errors, inconsistent pay cycles, and improbable YTD progressions.

- Database and employer verification: Reviewers confirm employment or match data against payroll records and supporting documents.

- Metadata scrutiny: Incoherent creation dates, missing producer fields, or over‑flattened PDFs can raise suspicion.

- Bank reconciliation: Net pay deposits should match the stub. Unexplained variances are escalated quickly.

- Legal exposure: In the US, the FTC and CFPB enforce against deceptive practices. The UK’s FCA and Canada’s FCAC and CRA have similar mandates.

Mini‑scenario: A borrower considers “fixing” a stub to smooth a variable commission month. Instead, they include an employer letter explaining the commission structure and provide three months of bank statements. The application is approved without altering the stub.

Altering numbers, dates, or parties risks more than a rejection—it can be fraud. For safe alternatives, see our article on the risks of using fake pay stubs.

When do you need professional pay stub formatting?

Not every application demands polish, but many benefit from it. Professional formatting helps when your stubs are scanned, misaligned, or inconsistent between pay periods. The goal is simple: reduce friction for busy reviewers so they can verify quickly and move forward.

Renters & tenants

Landlords and property managers often request two or three recent stubs to confirm steady income. In competitive markets, clean and legible stubs prevent unnecessary follow‑ups. Our guide on pay stub formatting mistakes lists pitfalls that make landlords question authenticity.

- What to include: 2–3 stubs, bank statements showing matching deposits, and (if requested) a recent W‑2/P60/T4.

- Helpful packaging: A single PDF with bookmarks, plus a short cover note clarifying pay frequency.

Auto loans & financing

Auto lenders typically ask for one to three stubs plus bank statements. If your scans are blurry or misaligned, they may be rejected. Learn more in our car loan pay stub guide. We can merge stubs and supporting statements into a coherent packet, highlighting the key figures for review.

- What to include: Recent stubs, bank deposits that match net pay, and a note for any one‑off adjustments.

- Common friction: Variable income (overtime/commissions) without a brief explanation page.

SBA & small‑business loans

SBA and small‑business lenders often request payroll summaries, tax returns, and bank statements. Sloppy documentation can delay approval or trigger manual review. Our formatting ensures alignment between stubs, summaries, and year‑end forms—without changing a single figure.

- What to include: Stubs, payroll summary reports, tax forms, and bank statements with matching deposits.

- Tip: Use consistent file names (e.g., “2025‑05‑15_PayStub_ABC‑Corp.pdf”) to speed triage.

Freelancers & self‑employed professionals

If you don’t receive traditional payslips, you may need a self‑employed pay stub derived from invoices and platform statements. This must reconcile to your 1099s (US), SA302 and Tax Year Overview (UK), or T2125 and NOA (Canada). Our post on creating legal self‑employed pay stubs explains how to do this without altering earnings.

- What to include: Invoice log, payout reports (e.g., payment platforms), bank statements, and the latest tax forms.

- Tip: Add a short “Methodology” note showing how totals were derived from invoices.

Cross‑border or remote workers

Working in one country and living in another complicates pay documentation. Different currencies, tax codes, and pay cycles may apply. Professional formatting labels conversions and YTD totals clearly and minimises confusion for reviewers.

- What to include: Original stub, the currency conversion used (with date), and matching bank deposits.

- Tip: Keep a simple conversion worksheet in the appendix of your PDF.

In every case, clarity wins. When in doubt, seek professional help rather than “tweaking” numbers. Our document services include bank statement formatting, proof‑of‑income editing, and cover‑sheet creation.

How does FinancialDocsProvider.com work?

We are not a paystub generator or payroll provider. We’re a specialist editing and formatting team that makes your existing documents easier to review and compliant with common requirements. Here’s our end‑to‑end process.

- Intake & scope definition: Tell us the goal, deadline, and jurisdiction. We confirm documents in hand and any required supporting materials.

- Document collection: Upload original pay stubs, W‑2s/1099s, invoices, bank statements, or other records via our secure portal. If something is missing, we’ll let you know—never guesswork, never fabrication.

- Reconciliation & verification: We cross‑check pay periods, math, and deposits. If discrepancies emerge, we flag them for you and suggest lawful ways to document the reality.

- Formatting & packaging: We rotate, crop, enhance, merge, and label pages. We add bookmarks, page numbers, alt text, and lawful redactions where appropriate.

- Quality assurance & delivery: A final review checks clarity and completeness. We deliver a secure PDF packet ready for submission.

Data protection: We apply least‑access principles, short‑term retention windows, and secure deletion after delivery. Only your approved files are edited, and we never modify factual content.

Turnaround depends on complexity. Simple formatting is often fast; larger packages can take longer. Pricing is transparent—see our pricing page for current rates—and we confirm costs before starting. Questions? Contact our team or learn more about our process.

What we don’t do: We don’t create employment that doesn’t exist, change numbers or dates, or “doctor” bank statements. If records don’t reconcile, we help you present them honestly—often with a simple explanation note from the employer or accountant.

What should be on a pay stub? Compliance checklist

A legitimate pay stub contains specific elements that allow reviewers to verify employment and income. Use the lists below to confirm that all essentials are present. Requirements vary slightly among the US, UK, and Canada; we highlight the common core and jurisdiction‑specific items.

United States

- Employee information: Full name and, optionally, masked Social Security number.

- Employer details: Company name, address, and EIN.

- Pay period & pay date: Start/end dates and date of payment.

- Hours worked & pay rate: Regular, overtime, and holiday hours with corresponding rate or salary.

- Gross wages: Earnings before deductions.

- Deductions: Federal, state, and local taxes; Social Security; Medicare; retirement contributions; insurance premiums; garnishments.

- Net pay: Take‑home amount after deductions.

- Year‑to‑date (YTD) totals: Cumulative totals for gross pay, deductions, and net pay.

Nice‑to‑have for reviewers

- Employee ID and department, if applicable.

- Check or deposit reference number to match against bank statements.

- A short notes line for legitimate anomalies (e.g., “retro pay for April overtime”).

United Kingdom

- Personal details: Name and National Insurance number.

- Employer information: Company name and PAYE reference.

- Pay period & date: Frequency (weekly or monthly) and payment date.

- Basic pay & additional earnings: Overtime, bonuses, and allowances.

- Deductions: Income tax, National Insurance, pension contributions, and student loan repayments.

- Net pay: Amount paid after deductions.

- Tax codes & YTD totals: The tax code used and cumulative earnings/tax to date.

Nice‑to‑have for reviewers

- Employer contact line or HR email for verification.

- Breakdown of variable pay items (e.g., shift differentials) if they influence affordability checks.

Canada

- Employee details: Name and masked Social Insurance number.

- Employer information: Business name and number.

- Pay period & date: Start/end of the pay period and payment date.

- Income: Regular wages, overtime, vacation pay, and other compensation.

- Deductions: Federal/provincial taxes, CPP contributions, EI premiums, pension or RRSP contributions.

- Net pay: Take‑home pay after deductions.

- Year‑to‑date totals: YTD earnings, deductions, and net pay.

Nice‑to‑have for reviewers

- Province noted if deductions vary by jurisdiction.

- Deposit reference number to simplify matching with bank statements.

Self‑employed workers: Your “stub” should be derived from invoices, payout statements, and tax filings. Ensure it reconciles to your self‑employed income summary, and include supporting documents (e.g., NOA, SA302, 1099s) in the same packet.

Packaging tips: Use clear file names, add a cover sheet summarising the pay frequency, and include a brief methodology note for unusual income structures. Reviewers appreciate professionalism and transparency.

What red flags make a pay stub look fake?

Small inconsistencies can undermine trust. The fastest path to approval is a stub that looks professional, is easy to read, and matches supporting records. Avoid the issues below to keep reviewers confident from the first glance.

- Inconsistent fonts and alignment: Multiple fonts or misaligned columns suggest a do‑it‑yourself approach rather than a payroll system.

- Mismatched numbers: Gross pay not equal to hours × rate, or YTD totals that don’t progress logically across pay periods.

- Missing or incorrect employer details: Generic business names, wrong addresses, or no contact information.

- Unrealistic deductions: Withholdings that ignore typical statutory rates are flagged quickly.

- Identical stubs across periods: Real stubs vary due to changing dates, hours, or deductions.

- Low‑quality or pixelated logos: Fuzzy graphics imply copy‑paste rather than system‑generated output.

- Metadata manipulation: Blank producer fields, implausible creation times, or multiple compression passes can indicate tampering.

- Bank statement discrepancies: Deposits should match net pay; unknown sources or recurring variance invite questions.

- Impossible timelines: A pay date that precedes the period end, or a YTD total that resets mid‑year without explanation.

- Rounding errors: Net pay rounded to whole dollars every period is unusual unless policy explains it.

- Currency confusion: Symbols and decimal separators inconsistent with the stated jurisdiction.

To learn how professionals spot fakes, read our article on how landlords and loan officers detect fake pay stubs. The best defence is accuracy and transparency: ensure stubs match bank deposits, tax forms, and employer records. Our team also specialises in bank statement formatting to align deposits with stubs.

Where can you find official resources & further reading?

Government agencies provide detailed guidance on payroll reporting, consumer protection, and fraud prevention. Use the sources below when confirming requirements or terminology for your jurisdiction.

- IRS Form W‑2 instructions – US guidance on annual wage reporting.

- CFPB – Consumer Financial Protection Bureau – Tips on choosing loans and understanding income verification.

- GOV.UK payslip rules – UK legal requirements for payslips.

- FCA Handbook – UK regulations on consumer credit and fraud prevention.

- CRA T4 information – Canadian guidance on payroll deductions and year‑end slips.

- FCAC – Canadian consumer protection agency with resources on income verification.

For deeper, scenario‑specific help, see our related articles:

- How to Read a Pay Stub: Simple Guide 2025

- Pay Stub vs W‑2: Which Proof of Income Should You Provide?

- Pay Stub vs Bank Statement: Which Is Better for Proof of Income?

- Creating Legal Pay Stubs When You’re Self‑Employed

- Pay Stub Formatting Mistakes That Trigger Rejections

Still unsure how to package your documents? Contact our team for personalised guidance.

Frequently Asked Questions

Below are common questions about pay stub authenticity, legality, and usage. If your question isn’t answered here, please reach out—we’re happy to help.

How can I tell if a pay stub is real?

A real pay stub uses consistent fonts and alignment, reflects actual hours and rates, includes employer and employee details, and matches bank deposits. It also shows cumulative YTD totals that move logically over time. Identical stubs across periods, missing employer details, unrealistic deductions, or math that doesn’t add up are red flags.

Is it legal to edit a pay stub for readability?

Yes. Editing for readability—rotating pages, enhancing contrast, adding text layers, or masking part of your Social Security number—is legal because it doesn’t alter facts. What’s illegal is changing amounts, dates, employers, or deductions. If you need help distinguishing, our proof of income editing team can advise.

What happens if I submit a fake pay stub?

Submitting falsified income documents can lead to immediate rejection, loss of deposits or fees, and potential legal penalties. Reviewers often use verification tools that cross‑check stubs against payroll records and banking data. If caught, you may be blacklisted and could face prosecution under fraud statutes.

Do I need to include my W‑2, P60 or T4 with my pay stubs?

It depends on the application. Many lenders ask for recent stubs plus your most recent W‑2 (US), P60 (UK), or T4 (Canada) to confirm annual earnings and withholdings. Providing both often speeds verification. In self‑employment cases, include invoices, tax returns, and bank statements.

How many pay stubs do lenders require?

Requirements vary. Landlords typically want two to three recent stubs; auto lenders may request one to three stubs plus bank statements; SBA and mortgage lenders often ask for several months of stubs with tax forms. Our auto finance guide explores the details.

Need accurate, reliable financial documents fast? Contact FinancialDocsProvider.com now.

Add comment