Last updated: August 2025. Fake pay stubs are a growing problem in housing and lending markets across the United States, United Kingdom and Canada. Fraudsters often tinker with fonts or round figures to make income seem consistent. The consequences of using or accepting fabricated documents range from application rejections to fines and criminal charges. At FinancialDocsProvider.com, we format and organize authentic records—we never invent or alter facts. Our goal is to present your real financial history clearly so reviewers don’t confuse it with the signs of fake pay stubs they’re trained to spot. :contentReference[oaicite:0]{index=0}

In this guide, you’ll learn what qualifies as a legitimate pay stub, why details like decimals and crisp fonts matter, and how to avoid edits that cross legal lines. You’ll also see how our team improves legibility and packages documents without changing content. Whether you’re a renter in Chicago, an entrepreneur in London, or a contractor in Toronto, our compliance‑first approach keeps you on the right side of the law.

Related Entities & Terms

The terms below appear in lender and landlord requests, government guidance, and payroll systems. Keeping them straight helps you assemble a complete, consistent file set that passes verification without delays.

- Payslip / Pay stub / Pay advice / Payroll statement

- W‑2, 1099‑NEC, 1099‑K (US); P60, P45, SA302 (UK); T4, T4A, Notice of Assessment (NOA) (CA)

- Year‑to‑Date (YTD) earnings; gross vs net pay; regular vs overtime hours

- Employer Identification Number (EIN), Social Security Number (SSN), National Insurance (NI) number, Social Insurance Number (SIN)

- Payroll providers (ADP, Paychex, Gusto), direct deposit statements and open banking exports

- Regulators: Consumer Financial Protection Bureau (CFPB), Federal Trade Commission (FTC), Internal Revenue Service (IRS); Financial Conduct Authority (FCA), HM Revenue & Customs (HMRC); Financial Consumer Agency of Canada (FCAC), Canada Revenue Agency (CRA)

- PDF/A, optical character recognition (OCR), metadata and file integrity

- Fraud screening, identity verification, KYC/AML checks

What are the legal basics of verifying pay stubs?

Across the US, UK and Canada, the law draws a bright line between improving readability and falsifying content. You can fix clarity issues, but you cannot change numbers, dates or employer details. Regulators treat any misrepresentation of income as potential fraud, regardless of intent.

In the United States, the CFPB and FTC enforce consumer protection and anti‑fraud rules. Submitting a fabricated pay stub to a landlord or lender can trigger civil penalties or criminal charges under state and federal law. The IRS also polices misstatements that intersect with tax reporting. In the UK, guidance from GOV.UK and the FCA emphasizes accurate income documentation. Canadian applicants must follow standards outlined by the FCAC and CRA.

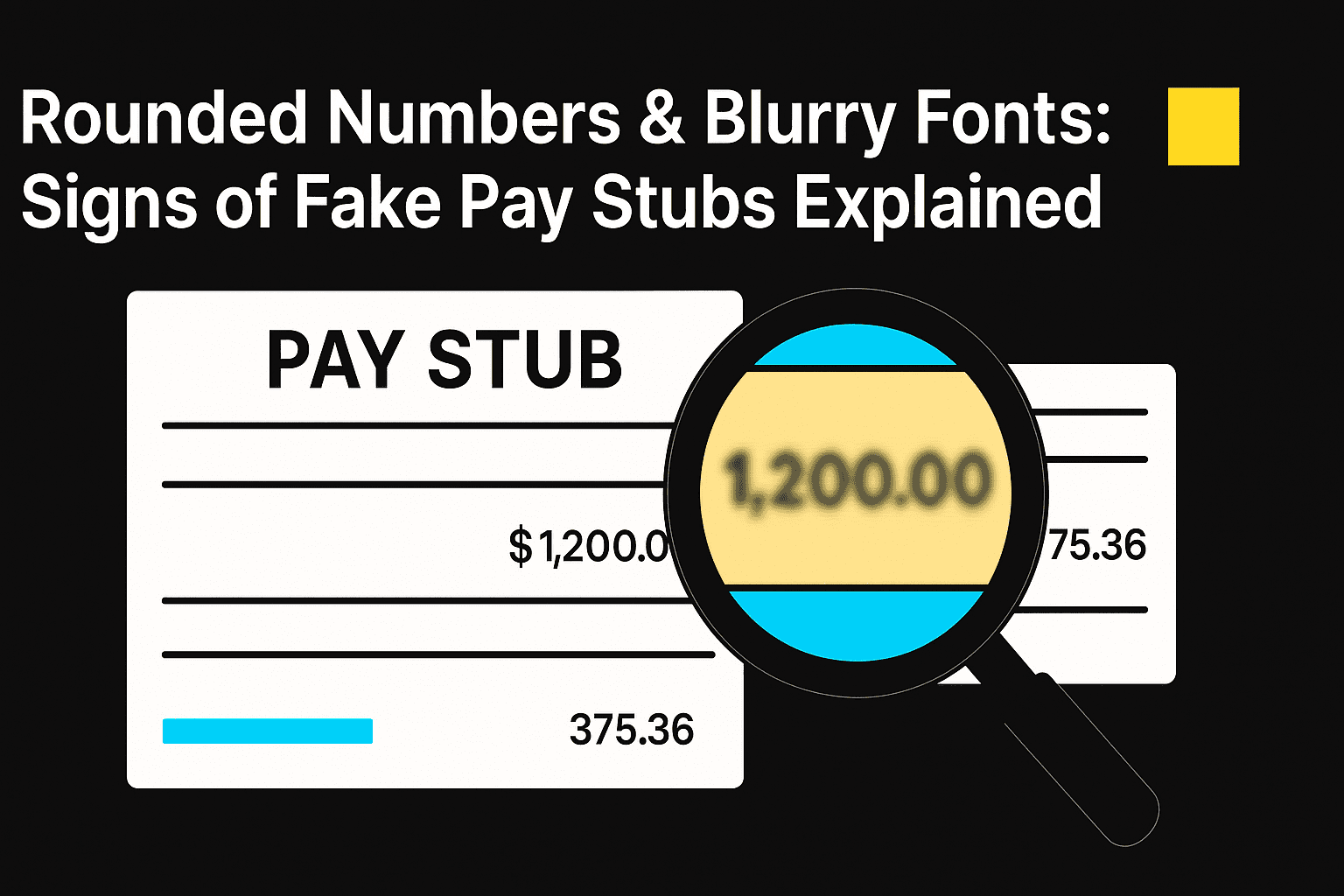

Legitimate pay stubs are issued by employers or payroll providers and itemize gross pay, deductions and net pay for each period—usually with cents or pence. Rounded numbers and blurry fonts are common signs of fake pay stubs because they suggest tampering. Reviewers routinely cross‑check stubs against bank deposits, tax forms and third‑party databases, which is why our team never alters factual content—we organize and clarify what already exists.

If you’re unsure whether a proposed change is permitted, test the intent: Does the edit improve readability—or does it hide, invent or modify income information? The first is usually legal; the second can be unlawful. Our editors stay current on regulatory expectations across the three jurisdictions so you don’t have to navigate them alone.

Which edits to pay stubs are allowed?

Allowed edits improve clarity, protect privacy or correct obvious typos without changing the underlying data. These adjustments help reviewers read the document quickly while preserving every number and date. Below are common, compliant edits we perform for clients.

Formatting and readability

You may convert scans to high‑resolution PDFs, straighten crooked pages and add bookmarks or page numbers. If the original is faint, increasing contrast or re‑scanning for legibility is fine. Adding explanatory labels—such as “gross pay” and “net pay”—is acceptable when they don’t alter amounts.

- Combine multi‑page stubs into a single, ordered PDF.

- Export to PDF/A to preserve fonts, layout and metadata.

- Use OCR to make text searchable without touching figures.

- Add a short cover page that lists included documents and dates.

Mini‑scenario: Your employer portal only lets you print low‑resolution images. We re‑scan or request the native PDF, then deskew, de‑speckle and bookmark the pages so underwriters can review them in seconds.

Redaction of sensitive information

Mask personal identifiers to reduce identity‑theft risk while leaving financial fields visible. Redaction should be precise, deliberate and limited to what a reviewer does not need to see.

- Redact the middle digits of SSN/SIN/NI numbers.

- Mask bank account and routing numbers except the last few digits.

- Blur signatures, barcodes or QR codes not required for review.

- Leave wages, dates, employer name and totals untouched.

Mini‑scenario: A landlord requests proof of income but doesn’t need your full SSN. We apply a consistent redaction style that keeps identifiers partial and leaves wages and dates intact.

Correcting obvious errors

When a stub contains typos or transposed address digits, annotate the error or obtain a corrected version from payroll. Many employers will re‑issue corrected stubs on request. If you attach both versions, label them clearly so reviewers know which to rely on. For more ways to avoid formatting mistakes, see our guide on common pay stub formatting mistakes.

Our proof of income editing service handles all of the changes above. We optimize file formats, consolidate pages and improve legibility so your documents clear automated screenings without raising questions.

What pay stub alterations are illegal?

Any change that misstates income, employment or deductions is illegal. Even “small” tweaks—like rounding numbers to look neat—can be treated as intentional misrepresentation. The examples below are among the most common mistakes that lead to denials, blacklists or legal action.

Changing amounts or rounding numbers

Adjusting gross pay, hourly rate or net pay—even slightly—misrepresents earnings. Authentic payroll rarely shows perfect whole numbers because taxes, benefits and overtime create uneven totals. If every period lands on $1,000.00 or £1,500.00, reviewers assume the figures were manufactured.

- Don’t “smooth” overtime or bonuses to look consistent.

- Don’t pad hours to meet a ratio a lender suggests.

- Don’t delete negative balances or recovery adjustments.

Altering dates or pay periods

Extending a two‑week period to a month, shifting pay dates or duplicating a period inflates income unlawfully. Underwriters compare stubs to bank deposits; date mismatches are easy to detect and hard to explain.

- Keep pay period start/end dates exactly as issued.

- Never duplicate a pay period to create a third stub.

- Don’t relabel monthly pay as semi‑monthly or weekly.

Inventing employers or deleting deductions

Substituting company names, changing addresses or removing taxes and insurance deductions is falsification. Employers are registered with tax authorities, and payroll providers keep consistent layouts and logos. Inconsistencies are easy to flag during verification checks.

- Do not replace the employer name with a shell entity.

- Do not remove tax lines to inflate net pay.

- Do not swap a payroll provider logo to “match” your template.

Consequences of fraudulent editing

Penalties vary by jurisdiction but are consistently severe. In the US, using a fake pay stub can carry fines and criminal exposure. The UK and Canada treat similar behavior as fraud under their criminal codes. Lenders and landlords also share data on problematic applications, which can lead to long‑term blacklisting. For a deeper dive, see our article on the risks of using fake pay stubs.

- Allowed: re‑scanning for clarity, redacting SSNs, annotating typos, bundling pages, exporting to PDF/A.

- Not allowed: rounding figures, erasing deductions, changing pay dates, inventing employers or work hours.

When do you need professional document formatting?

Sometimes your genuine pay stubs don’t meet a reviewer’s technical requirements. Professional formatting ensures legitimate documents aren’t rejected for avoidable reasons. The scenarios below show when our expertise can prevent delays or secondary reviews.

Renters and tenants

Landlords and property managers often request the last two or three pay periods, plus bank statements. In competitive markets—say, a Chicago neighborhood with dozens of applicants—blurry screenshots or missing pages are quick grounds for rejection. We convert employer‑issued payslips into clean PDFs and check that YTD totals track logically with previous periods. Pairing stubs with deposit confirmations or an employer letter can further reduce friction. See our article on how landlords and loan officers detect fake pay stubs for more insight.

- Do: Provide consecutive pay periods and matching bank deposits.

- Don’t: Send cropped images or partial pages that hide totals.

Car loans and auto financing

Auto lenders analyze your debt‑to‑income ratio and verify employer details. Poorly formatted pay stubs can trigger manual reviews, slowing approvals. We align file metadata, timestamps and totals with your bank deposits and W‑2 forms so the submission is cohesive and verifiable end‑to‑end.

- Do: Include stubs that bracket the application date.

- Don’t: Mix screenshots with PDFs in random order.

SBA loans and small‑business financing

Small‑business applicants are often asked for owner draws, payroll summaries and tax transcripts. Reconciling these records can be time‑consuming. We match payroll outputs to income schedules and format them consistently so reviewers can trace each figure without guesswork.

- Do: Label documents by period and account.

- Don’t: Submit exports with missing pages or mismatched totals.

Self‑employed and freelancers

Independent contractors don’t receive traditional pay stubs. Instead, they provide invoices, 1099s and platform statements from services like Upwork or Etsy. Our self‑employed pay stub guide explains how to build a compliant “pay stub equivalent” that summarizes income and reconciles to tax returns. We then package those documents into a polished, reviewer‑friendly PDF.

Across these situations, proactive formatting prevents your authentic records from looking suspicious. It also helps you avoid the telltale signs of fake pay stubs—like rounded totals and mismatched typography—that invite extra scrutiny.

How does our pay stub formatting process work?

Our process is structured, transparent and aligned with legal expectations. From first contact to final delivery, we focus on clarity, traceability and data security. Here’s how we handle your documents—without altering facts.

Intake and assessment

Upload your existing pay stubs, bank statements or tax forms through our secure portal. We review each file for completeness and authenticity. If anything is missing—such as a final page or a deposit confirmation—we’ll request it. We do not accept altered or incomplete records.

Reconciliation and verification

We reconcile pay‑stub figures with the records you provide. Salaried employees are checked against bank deposits; freelancers are aligned to 1099 totals and tax filings. If a discrepancy appears, we flag it for you to address with your employer or accountant before formatting proceeds.

Formatting and packaging

After the data checks out, we straighten scans, enhance contrast, add page numbers and bookmarks, and bundle pages into a single PDF. Sensitive identifiers are partially redacted. When appropriate, we add a brief annotation—for example, noting that an employer corrected an error on a subsequent stub. All exports follow PDF/A standards for durability and integrity.

Quality review and delivery

Before delivery, we run a final quality review for consistent fonts, readable logos and matching totals. We then provide a secure download or encrypted email package, plus a checklist of the actions taken. If we detect potential fraud—such as inconsistent pay figures or missing employer information—we stop work and refer you to our contact team. We do not fabricate or modify factual content under any circumstances.

What’s on the compliance checklist?

Run through this list before sending your pay stubs to any lender or landlord. A few minutes of prep can prevent delays, denials and avoidable accusations of misrepresentation.

- Gather originals: Obtain the most recent pay stubs directly from your employer or payroll portal. Ensure they cover the exact timeframe requested.

- Confirm totals: Verify that gross pay, deductions and net pay match bank deposits. Avoid rounded figures; keep cents/pence.

- Check dates: Confirm the pay period and pay date align with your employment contract and deposit timestamps.

- Review formatting: Look for consistent fonts, clear logos and evenly spaced columns. Blurry or mismatched fonts attract scrutiny; fix readability issues without touching figures.

- Redact responsibly: Mask the middle digits of SSN/SIN/NI numbers and account numbers, leaving wages, dates and employer names visible.

- Compile supporting documents: Pair stubs with W‑2s, 1099s, T4s, Notices of Assessment or bank statements so reviewers can cross‑reference totals.

- Maintain metadata: Preserve file creation dates and author fields when exporting. Use PDF/A tools to keep fonts embedded.

- Name files clearly: Use a consistent pattern (e.g., EmployerName_YYYY‑MM‑DD_PayStub.pdf).

- Keep copies: Save original and formatted versions in a secure folder for future applications.

- Get professional help: If you’re unsure about any step, contact our financial document services team for guidance.

A thorough check now saves you hours later—and keeps your file well clear of the pitfalls that mimic the signs of fake pay stubs.

What red flags should you avoid?

Reviewers are trained to spot inconsistencies and visual cues that hint at manipulation. The most common signs of fake pay stubs include overly neat numbers, inconsistent typography and totals that don’t reconcile. Avoid the red flags below to keep your genuine documents from triggering manual review.

- Rounded numbers: Perfect whole numbers across periods often suggest the figures were manufactured.

- Blurry or mismatched fonts: Typeface changes or fuzzy text at different zoom levels imply splicing or edits.

- Inconsistent totals: YTD figures that don’t equal prior periods—or don’t match tax forms—raise questions.

- Missing deductions: Authentic stubs include taxes, insurance and retirement contributions; their absence is suspect.

- Out‑of‑sequence dates: Overlapping or non‑chronological pay periods may indicate tampering.

- Altered metadata: Erased author fields or odd software signatures can trigger secondary review.

- Strange logos or addresses: Mismatched employer names, outdated logos or wrong addresses signal forgery.

- Spelling errors and misaligned text: Typos, uneven columns or clipped lines suggest a hastily assembled document.

- Overuse of screenshots: Low‑resolution images instead of native PDFs can conceal edits.

- Math mistakes: Deductions that don’t add up or net pay that exceeds gross pay are obvious errors.

- Unverifiable contacts: Employer phone numbers or emails that don’t appear on official channels undermine credibility.

Steering clear of these pitfalls helps your real records get the fair, fast review they deserve. For a deeper look at what professionals check, see our article on how lenders detect fake pay stubs.

Where can you find resources and help?

Staying informed is your best defense against fraud and compliance issues. Bookmark the official resources below to understand your rights, obligations and the standards reviewers apply.

- CFPB – Consumer Financial Protection Bureau (US)

- FTC – Federal Trade Commission (US)

- IRS – Internal Revenue Service (US)

- GOV.UK – Guidance on earnings and payslips (UK)

- FCA – Financial Conduct Authority (UK)

- FCAC – Financial Consumer Agency of Canada

- CRA – Canada Revenue Agency

For practical guidance and examples, browse our related posts:

- Common pay stub formatting mistakes

- Risks of using fake pay stubs and safe, legal alternatives

- How landlords and loan officers detect fake pay stubs

- Self‑employed pay stub guide

- Proof of income editing & bank statement formatting services

- About our process

If you still have questions or need hands‑on help, don’t hesitate to contact our team. We’re here to guide you through compliant document preparation.

FAQs

Below are concise answers to the questions reviewers and applicants ask most. Each response favors clarity and compliance so you can act with confidence.

Why are rounded numbers a red flag on pay stubs?

Real payroll calculations include taxes, insurance and other deductions that rarely produce perfectly even amounts. When every pay period shows rounded figures without cents or pence, reviewers suspect the numbers were fabricated. Always present the exact amounts on your genuine pay stub.

How can I tell if a pay stub font has been altered?

Watch for inconsistent typography: a font that changes mid‑document, blurry letters or misaligned columns. Compare the stub to other documents from the same employer. Legitimate payroll providers use consistent fonts and layouts; abrupt typeface shifts or pixelation may indicate editing.

Is it legal to redact sensitive information on a pay stub?

Yes. You may redact portions of your SSN/SIN/NI and bank account numbers to protect privacy. Keep wages, dates, employer names and totals visible. Redaction should never hide or alter income details.

What should I do if my document is rejected for formatting reasons?

Ask the reviewer which element failed—blurry text, missing pages or mismatched totals. Retrieve a fresh copy from your employer if possible. Then consult our guide on common formatting mistakes or get help from our financial document services team to improve clarity without changing facts.

Can I round numbers for simplicity if I provide supporting bank statements?

No. Rounding earnings or deductions—even with supporting bank statements—creates discrepancies between documents. Reviewers may view those gaps as intentional fraud. Use the exact figures from your pay stub and let the supporting documents speak for themselves.

Need accurate, reliable financial documents fast? Contact FinancialDocsProvider.com now.

Add comment